Variable rate home loans

Pay down your loan faster

Link an offset account or make as many extra repayments as you like.*

Do more with less

Owner occupiers could borrow up to 98% of the property value including LMI. Other lending criteria apply.

Redraw when you want

Unlimited redraw available when you have surplus balance available.

Pay when it suits

Flexible payments to suit your pay cycle – just meet your minimum monthly amount.

Just a home loan, or the complete package

A variable loan for full flexibility

Whether you’re buying or refinancing, our variable loans give you options.

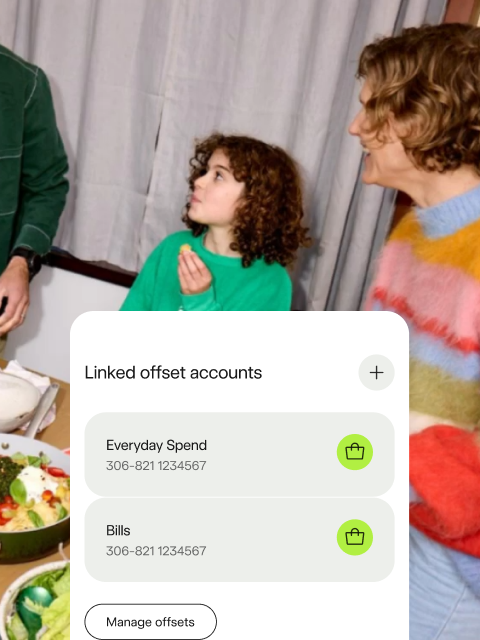

Get 100% interest offset across multiple offset accounts, and make unlimited additional repayments and redraw.*

For a balance between flexibility and security, you can split your loan amount between a variable rate and a fixed rate.

What you’ll get with a Bankwest home loan

Know where you’re at, at a glance

A home loan with personal service

Our lenders are here to support you with your home loan when and how it suits you.

How to apply

It’s time to get started

Meet your lender

Tell us about your situation, and we’ll connect you to your specialist lender who’ll help you through the application.

Get pre-approval

If you need pre-approval so you can start your property search, your lender can help you.#

Finalise your loan

Your lender will help you understand which documents are needed to finalise your loan.

Want to talk about buying or refinancing?

Compare the details

Bankwest Simple Home Loan

Complete Variable Home Loan

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Description A simple, flexible, variable rate loan designed to save you fees. | Description A variable rate home loan, plus the flexibility to add on other good stuff – like multiple offset accounts and an eligible credit card.*^^ |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Minimum loan $20,000 | Minimum loan $200,000 |

Fixed rate term Not applicable | Fixed rate term Not applicable |

Maximum loan term 30 years | Maximum loan term 30 years |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Offset facility 100% offset available* | Offset facility 100% offset available* |

Eligible credit card Not included | Eligible credit card Optional – annual fee waived^^ |

Property valuation 1 standard valuation, fees apply for additional## | Property valuation No valuation fees apply |

Redraw Available | Redraw Available |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Loan maintenance fee $0‡ | Loan maintenance fee $0‡ |

Annual fee $0‡ | Annual fee $395‡ |

Application fee $0 (usually $695)‡~ | Application fee $0‡ |

Settlement fee (legal disbursement fee) $350‡ | Settlement fee (legal disbursement fee) $350‡ |

Loan increase fee $295‡ | Loan increase fee $0‡ |

Redraw fee $0‡ | Redraw fee $0‡ |

Progress payment fee $80 per progress payment‡ | Progress payment fee $0‡ |

Fixed rate break admin fee Not applicable‡ | Fixed rate break admin fee Not applicable‡ |

Fixed rate break cost Not applicable‡ | Fixed rate break cost Not applicable‡ |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Payment frequency Flexible | Payment frequency Flexible |

Extra repayments Unlimited | Extra repayments Unlimited |

Interest only Up to 5 years available | Interest only Up to 5 years available |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Offset amount 100%* | Offset amount 100%* |

Monthly fee $10 per account | Monthly fee $0 |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Up to 60% LVR 5.69% p.a. variable rate | Up to 60% LVR 5.69% p.a. variable rate |

Up to 80% LVR 5.74% p.a. variable rate | Up to 80% LVR 5.74% p.a. variable rate |

Up to 90% LVR including LMI 6.04% p.a. variable rate | Up to 90% LVR including LMI 6.04% p.a. variable rate |

Up to 95% LVR including LMI 6.64% p.a. variable rate | Up to 95% LVR including LMI 6.64% p.a. variable rate |

Up to 98% LVR including LMI 8.27% p.a. variable rate | Up to 98% LVR including LMI 8.27% p.a. variable rate |

| Bankwest Simple Home Loan | Complete Variable Home Loan |

|---|---|

Up to 60% LVR 5.94% p.a. variable rate | Up to 60% LVR 5.94% p.a. variable rate |

Up to 80% LVR 5.99% p.a. variable rate | Up to 80% LVR 5.99% p.a. variable rate |

Up to 90% LVR including LMI 6.39% p.a. variable rate | Up to 90% LVR including LMI 6.39% p.a. variable rate |

Up to 95% LVR including LMI 7.39% p.a. variable rate | Up to 95% LVR including LMI 7.39% p.a. variable rate |

Making the most of your loan

Pay off your loan as fast as possible

Home loan terms, explained

Fund a renovation

The home loan process

From conditional approval to settlement, we break down the stages for you.

Increasing your home loan

Unlock more funds by borrowing against the equity you’ve built up on your current property.

Find the right loan for you

Common questions

With a variable rate home loan your interest rate can go up and down as rates change. This means your repayments can go up and down too.

With a fixed rate home loan you can lock in your rate for up to five years. This means your rate won’t change during your fixed term and neither will your repayments.

If you’ve built up enough usable equity in your current property, you could put this towards an investment property.

Loans for a property to live in (owner-occupier loans ) include but aren’t limited to loans to fund the purchase of a property, refinances of existing loans, and land or construction loans, where the borrower currently lives or intends to live at the property.

Loans for an investment purpose (investor loans) include but aren’t limited to loans where the predominant part is used to invest in an established property, construction or land. They also include refinancing an investor loan.

Principal and interest (P&I) refers to when your loan repayments cover both the loan amount portion (the principal) and the interest owing on that loan. This means the amount you owe will reduce over time.

Interest only (IO) repayments cover just the interest for an agreed period of time. This means the amount you owe won’t decrease during this time.

When you refinance your home loan to a new lender, you essentially take out a new loan. Therefore, you’ll encounter similar application and bank fees. You should also check with your current lender whether any discharge or break fees apply. The good news is that you won’t need to pay stamp duty when refinancing, as you already own the property.

Things to consider

- Lending and eligibility criteria, and fees and charges, apply for our home loans. Rates are subject to change.

- Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

* Offset accounts

Offset Transaction Accounts must be held in the same name as the associated loan account. Fees and charges may apply. Credit interest is not payable on the Offset Transaction Account. Where a monthly offset fee applies it will be charged to each offset account held, not the home loan.

With our Complete Fixed and Fixed Rate home loans maximum 40% offset is available. Other exclusions apply.

For the Fixed Rate Home Loan no offset fee applies during the fixed term, however a $12 monthly loan maintenance fee applies. At the end of the fixed term, a $10 monthly offset fee applies per offset account.

† Principal and interest repayments

Different rates apply for interest only repayments, contact your broker or Bankwest Lender to find out more. Rates are subject to change.

# Pre-approval (approved in principle)

Pre-approval, or 'approved in principle' is a letter that indicates the amount we might be able to lend to you. This can give you a good idea of what your borrowing power might be before you go house-hunting. It's based on the information you've given us (without validation or assessment) and is issued after we perform a credit check.

This is different from a conditional approval, where your information is validated and assessed before it's issued.

^^ Complete Home Loan Package

Package consists of an eligible home loan, one optional eligible credit card per customer and up to nine optional Offset Transaction Accounts per loan. The Complete Home Loan Package is closed when all home loans included in the package are closed. Under the package, only one optional Bankwest Qantas Mastercard, Bankwest More Mastercard or Breeze Mastercard account is allowed per customer. Minimum credit limit is $3,000 for the Bankwest Qantas Platinum Mastercard, $1,000 for the Bankwest More Classic Mastercard and the Breeze Classic Mastercard, and $6,000 for the Bankwest More Platinum Mastercard and Breeze Platinum Mastercard, and $12,000 for the Bankwest More World Mastercard and Bankwest Qantas World Mastercard.

If you take out a Bankwest Complete Home Loan for investment purposes, you will be contacted by DEPPRO Pty Ltd. Bankwest does not endorse or approve the depreciation schedule prepared by DEPPRO Pty Ltd.

## Property valuation fee

Any amount in excess of the standard fees is to be met by the customer.

‡ Other fees and charges apply

When you buy a property, other fees may apply, including government and bank fees. Calculate stamp duty, LMI and other upfront costs of buying a home. Rates and fees are subject to change. A full list of fees will be set out in your home loan contract.

Download the Key Facts Sheet for these products.

~ Application fee

Includes legal fees for standard mortgage preparation and one standard valuation fee. Any amount in excess of the standard fees is to be met by the customer.

Loan to Value Ratio (LVR)

Loan to Value Ratio (LVR) is the portion of money you are borrowing in relation to the value of the property. For example, if you borrow $400,000 to buy a property worth $500,000, your LVR is 80% (400,000/500,000).

Lenders Mortgage Insurance (LMI)

Lenders’ Mortgage Insurance (LMI) is insurance to protect your lender if you have trouble with your repayments in the future. LMI can be an added expense when you’re buying your home, but you can avoid it if you save 20% or more of the value of the property.

Redraw

There is no minimum redraw amount.

Important documents

Offset Transaction Account terms and conditions

The relevant Product Schedule together with all of the related documents form the complete Product Disclosure Statement for this product.