The more you have in your offset account, the sooner you could pay off your loan. 1 Offset Transaction Account must be held in the same name as the loan account. Maximum 40% offset is available with our Complete Fixed and Fixed Rate home loans. Other exclusions apply. Account holders must be 18 years or older. Other fees and charges may apply. Credit interest is not payable on this account. Where a monthly offset fee applies, it will apply to each offset account held.

Offset account

You could save on your home loan interest by pairing an Offset Transaction Account with your eligible home loan and using it like an everyday bank or savings account.

Why choose an offset account?

How does an offset account work?

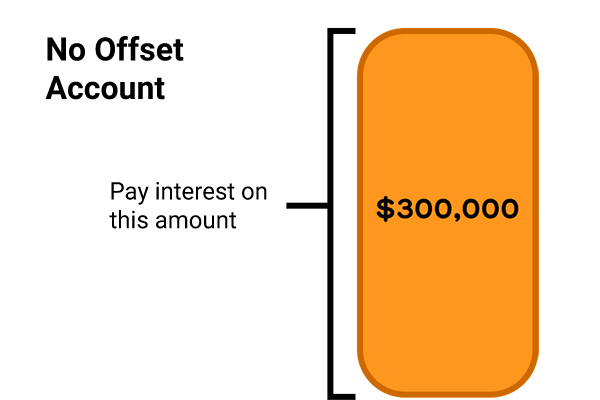

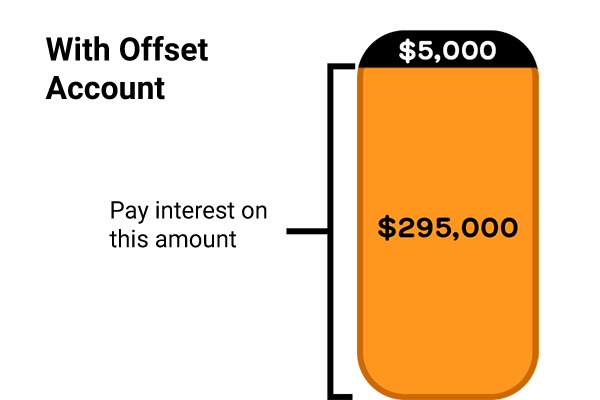

You can use an offset account like any everyday bank or savings account. The difference is any money you have in it is offset against your home loan, which reduces the interest you pay. Interest on your loan is calculated daily, so the more you have sitting in your offset account on any given day, the less interest you’ll be charged.

Let’s say you had $300,000 owing on your Bankwest loan and $5,000 in your offset account. With 100% offset on a variable loan, the interest for that day would be calculated on a loan balance of $295,000. If you had a fixed loan with 40% offset, it’d be calculated on $298,000.

For more information, download the Mortgage Saver Offset Facility customer information sheet (PDF).

Rates and fees

See the offset potential of your home loan.| Name | Offset available | Monthly offset fee |

|---|---|---|

|

100%

|

$0

|

|

|

40%

|

$0

|

|

|

100%

|

$10 per offset account

|

|

|

Fixed Rate Home Loan (within the term)

|

40%

|

$0

5

At the end of the fixed term a monthly offset fee of $10 per offset account will apply.

|

The relevant Product Schedule together with all of the related documents form the complete Product Disclosure Statement for this product.

Product Schedule:

Bankwest Offset Transaction Account Product Schedule (PDF)

Related documents:

You can open single or joint offset accounts in the app if you have an eligible home loan. ? Eligible products include our Complete Variable Home Loan, Complete Fixed Home Loan, Simple Home Loan or Fixed Rate Home Loan.

Open in the app

- Tap ‘Open or browse products’ from your ‘Home’ or ‘More’ screens

- Tap 'Everyday accounts' and select 'Offset accounts'

- Follow the prompts.

If you don't have a home loan with Bankwest yet, check our home loan options.

A new look bank card, designed for accessibility

All Bankwest debit cards now feature a vertical design and built-in notch so you know which way to insert your card at the checkout and ATM. Plus, the card number, signature panel and expiry date are on the back, helping to keep all card details safe and secure.

Frequently asked questions

Info at your fingertips

Unlike a savings account, an offset account is linked to your home loan, and when used, it can reduce the amount of home loan interest you pay over time. More often than not, a savings account rewards you for untouched savings with bonus interest or rewards points.

A redraw facility is a feature on your home loan, while an offset account is a separate account that’s linked to your home loan.

Both can help you save on home loan interest, but by using an offset account, you can keep track of your savings separately and access funds anytime with a debit card.

Having multiple offset accounts with a Complete Home Loan Package could help you manage your money more easily, by using them for specific things – like savings, bills and spending. Plus, you could save on home loan interest at the same time. It’s a win-win we call ‘bucketing’. And you can track it all in our app. Learn more.

Need help with your offset account application?

Let us know and we'll get in touch.

Looking for something else?

- Offset Transaction Account must be held in the same name as the loan account. Maximum 40% offset is available with our Complete Fixed and Fixed Rate home loans. Other exclusions apply. Account holders must be 18 years or older. Other fees and charges may apply. Credit interest is not payable on this account. Where a monthly offset fee applies, it will apply to each offset account held.

- Overseas and local non-bank ATM operators may charge a fee. Other fees and charges may apply.

- For this account, Platinum Debit Mastercard access is available to Australian citizens and temporary or permanent residents over 18 with an Australian residential address (limited exceptions may apply subject to conditions).

- Maximum 40% offset applies to Fixed Rate Home Loan and Complete Fixed Home Loan.

- At the end of the fixed term a monthly offset fee of $10 per offset account will apply.

Lending and eligibility criteria, and fees and charges, apply for our home loans, including an annual package fee of $395 for the Complete Home Loan Package. Complete Home Loan Package consists of an eligible home loan, one eligible credit card per customer and up to nine optional Offset Transaction Accounts per loan.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Consider the applicable product PDS available from Bankwest before deciding whether the product is right for you. Fees and charges may apply and subject to change.

Easy Alerts are available for mobile personal banking accounts on eligible devices in which you have the Bankwest App installed and notifications enabled. Limited alerts only are available for credit products. Consider the Product Disclosure Statement (PDS) and Bankwest App Terms of Use available from Bankwest before deciding whether the product is right for you. Fees and charges may apply with the App.

Target market determinations are available from www.bankwest.com.au/tmd.

Bankwest Apple Pay Terms of Use apply. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc. App Store is a service mark of Apple Inc.

Terms of Use apply to the use of Google Pay. Android, Google Pay, Google Play and the Google Play logo are trademarks of Google LLC.

The information contained on this web page is of a general nature and is not intended to be nor should it be considered as professional advice. You should not act on the basis of anything contained in this web page without first obtaining specific professional advice. Also to the extent permitted by law, Bankwest, a division of Commonwealth Bank of Australia ABN 48 123 123 124 AFSL / Australian credit licence 234945, its related bodies corporate, employees and contractors accept no liability or responsibility to any persons for any loss which may be incurred or suffered as a result of acting on or refraining from acting as a result of anything contained on this web page.