Scams can take a number of forms, but here are the most common ones.

Latest banking security threats

What do scams look like?

Cold calls

This is when scammers call you and pose as either us or a different company to try and get personal details from you.

Emails

These involve scammers sending you fake emails to try and get you to follow a link, which prompts you to enter personal details.

SMS'

These involve scammers sending a fake SMS with a link to a form or website that’s used to try and steal your details.

Rest easy knowing we have local experts trained in scam detection working 24/7

Latest threats

Impersonation scams

Scammers are impersonating genuine institutions (such as banks) using staff names and even producing brochures and marketing materials with company logos. When offering products like term deposits or bonds, they often lead with competitive rates and include fake offer-ending dates to create a sense of urgency. The best way to confirm legitimacy is to check the organisation’s website by typing in the organisation’s website address or contacting them directly.

Things to look out for:

- Unsolicited emails that offer investment opportunities, from fake email addresses

- Links and/or pop-ups on websites personalised to you, appearing on social media

- Investment rates that seem too good to be true and have an ending date

- Attempts to gain your trust, with suggestions of what to say to your bank

- Requests for multiple payments to be made as ‘deposits’ in order to set-up an account.

Phishing scams

Phishing scams are more active during periods of higher consumer spending – like the lead up to the end of the year, and new year sales. In these situations, scammers rely on impulse triggered behaviours to get you to act quickly, encouraging you to provide your personal information without thinking about it. They often pretend to be from larger, well-established organisations to gain your trust and will attempt to steal your online banking logins and credit card details.

Things to look out for:

- Text messages or emails received with a sense of urgency

- Requests to hand over personal details including a one-time SMS or email code

- If a postal, delivery or courier service contacts you that you are unfamiliar with.

Travel and accommodation booking scam

This phishing scam targets users of accommodation sites like Booking.com. People are receiving a message from official website email addresses like ‘noreply@booking.com’ or from the messaging function within the booking app.

The message claims a booking will be cancelled if customers don't input credit card details through a provided link. The message or email is typically received when a customer has recently booked accommodation, is due to check-in, or has already checked in.

If you've received a message or email that doesn't seem genuine or includes an urgent call to action, don’t click the link or share any personal information. Ask someone you trust or contact the organisation directly using the phone number listed on their official website.

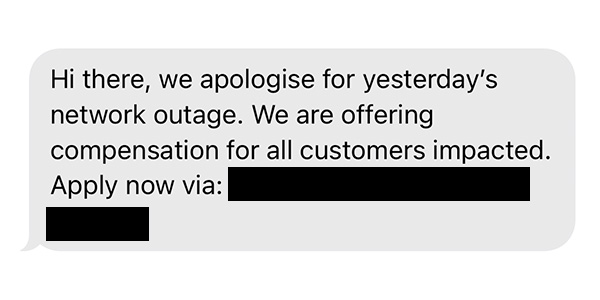

Optus outage scam

People are receiving a text message from a number claiming to be Optus offering compensation for the recent network outage on 8 November 2023. The text reads:

“Hi there, we apologise for yesterday’s network outage. We are offering compensation for all customers impacted."

The message directs recipients to a link where they can apply for their supposed compensation. Please disregard it and do not click on any links or provide any personal information.

Celebrity bitcoin and investment scam

This one involves either an email or a celebrity endorsed Facebook ad that encourages you to invest money or buy bitcoin. Things to look out for:

- Emails or ads that try to get you to click on a link

- Prompts to enter your bank details

- Direct messages from people on social media asking you to invest – always verify any messages you get asking to click on links, or send or receive funds

- Facebook posts tagging a lot of people that feature a photo of a celebrity.

Fake NBN or ATO call

NBN calls

An example of a cold call scam, this one involves receiving a call from scammers claiming to be fixing your NBN. They then attempt to get remote access to your computer or internet connection where they can transfer funds from your account.

ATO calls

Currently very common, this is where scammers call you claiming to be from the ATO. They may request you to provide personal details to be verified, notify you of an outstanding debt, or request bank account details for payments or refunds. They may also threaten you with prison if you don’t provide details. If you receive one of these calls, make sure you don’t provide any details. You can also report it directly through the ATO website.

If you receive calls like this, don’t follow any instructions and hang up straight away.

Fake Microsoft pop-up

For this one, scammers create a pop-up on your screen that claims your computer has a fatal virus. It prompts you to call a number which gives scammers remote access to your account.

Fake voicemail SMS

Also called a ‘flu-bot’ scam, this has been a common scam since August 2021, involving a text message from a random number notifying you of a new voicemail. The text provides a link to click in order to access the voicemail, usually with spelling errors and unusual URLs. If you get a text like this, don’t click on the link and delete the message – clicking the link could lead to malware being downloaded on your phone.

Phone spoofing

This is where scammers try to hide their identity by replacing their number with another number. This means they can call you from a number known to you to make you think you’re being contacted from a recognised caller.

We’re currently seeing instances of customers getting calls from what appears to be a Bankwest number (do not dial, for example only - 9449 2840). The callers will often say they’re from our security team, and that they’ve detected fraud on your account or need your help to catch a scammer.

Remember – we’ll never ask you for any of your banking details or login info, or to download anything. If you have any doubts, you can call us on a verified number from a genuine source – like our website.

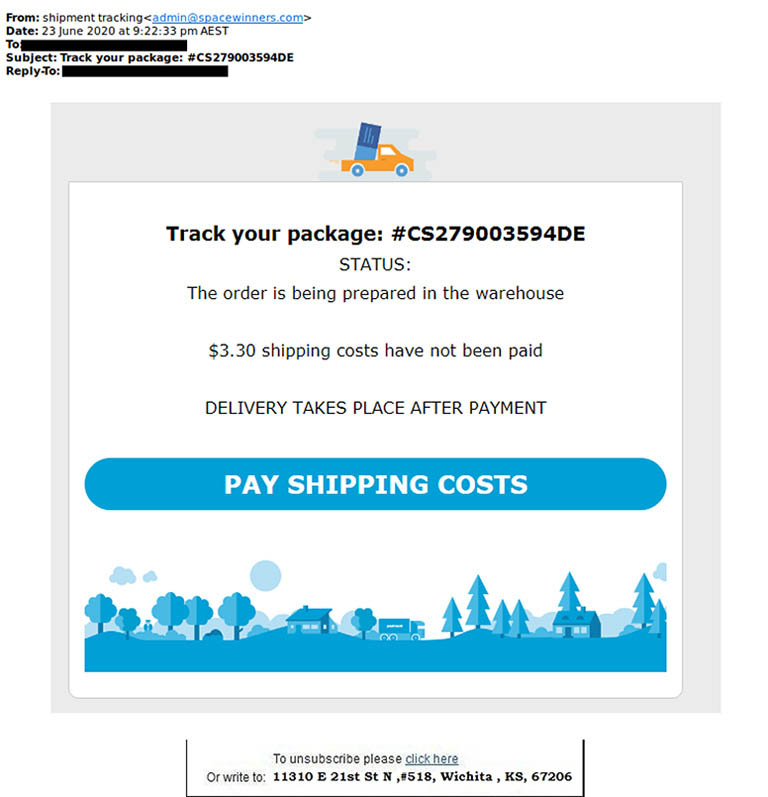

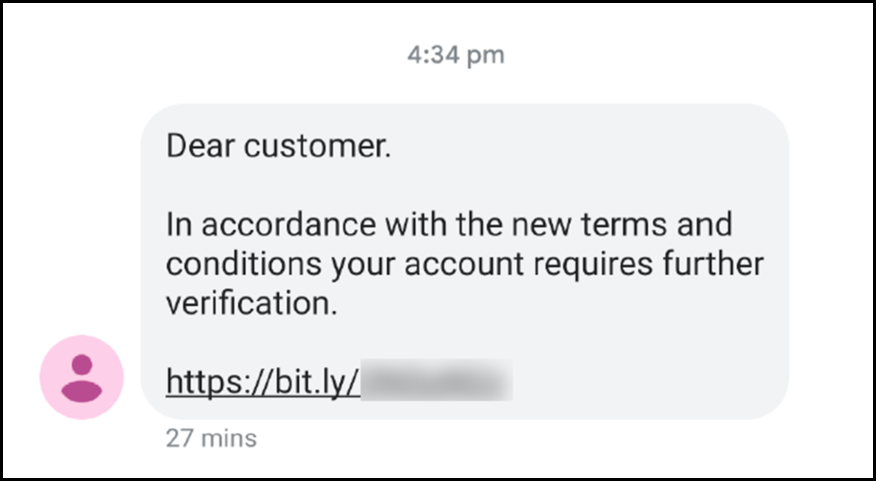

Mail delivery scams

This scam tries to get access to your card details by claiming to be from postal delivery services, both via email and SMS. The email, which you can see an example of, prompts you to pay for shipping costs for a parcel delivery and gives you a link to a fake website which tries to get you to enter your card and personal details. Remember, phishing websites are designed to look like ours, but have a different URL (we’ll never send you a link using https://bit.ly).

The SMS version of this scam claims that a parcel has been kept at a sorting office for you. It also contains a link to a fake website to try and prompt you to pay a fee to release the parcel. If you receive either of these messages, don’t click on the link or respond.

Coronavirus-related scams

We’re currently seeing many instances of scammers impersonating business and government authorities using COVID-19 messages. We’ve also seen a number of coronavirus-related online shopping scams.

A few specific examples to watch out for are:

Flight refund scam

Scammers are targeting people who are waiting for refunds from airlines that cancelled flights due to the coronavirus shutdown. They're doing this a couple of ways:

- Creating fake airline websites (such as Qantas and Virgin) where customers are prompted to call a fake number and tricked into giving card details and an SMS code so a refund can be issued

- Sending messages to customers with a fake flight refund form and telling them to fill it in with their name and credit card details.

Using these tricks, cybercriminals could collect personal and financial information and use them to carry out a broad range of malicious activities. Data gathered could also be offered for sale on the dark web.

To confirm the source of emails or messages you receive, and to verify that you're not getting contact details from fake websites, directly contact the company using a phone number from the White Pages online directory.

Texts from ‘GOV’ or ‘MyGov’

There have been multiple reports of texts that appear to come from ‘GOV’ or ‘MyGov’, with suspicious links to more information related to COVID-19.

For more information about coronavirus related scams, visit the Stay Smart Online and Scamwatch websites.

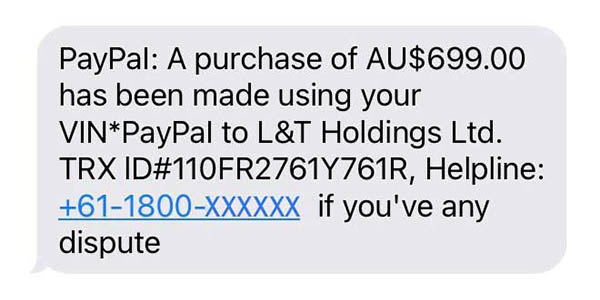

PayPal SMS scam

This involves scammers sending fake SMS’ pretending to be from PayPal. The SMS claims that you’ve made a purchase on your PayPal account, and gives you a number to call. Calling this number connects you with the scammer directly, where they’ll ask you for your card details and SMS code (they might even know the last 4 digits of your card) – make sure you ignore SMS’ like this.

Common threats

Cold calls

This is where scammers call customers and pose as us to request card details. If you receive a call like this, make sure you don’t give out any details and hang up straight away.

Amazon scam

This one involves an email or phone call from scammers pretending to be from Amazon. Scammers claim that you’re due for a refund and prompt you to give your card details. If you receive an email or call like this, make sure you don’t reply or provide any card details. It might also be a good idea to reach out to Amazon directly to let them know.

If you’ve followed any of these links or think a scammer has your details, make sure you get in touch.

Fake Bankwest fraud investigation call

Scam callers can pretend to be a part of our fraud department, asking you to help with an internal investigation.

They ask you to confirm the amount of money in your account and to withdraw cash to deposit at another bank. The scammer also asks you not to speak to anyone, so you don’t tip off the employee being investigated.

If you’ve received a call like this, don’t provide any of your details or do as they ask. If you already have, call us on 13 17 19. Remember, we’ll never ask a customer to participate in an internal investigation or transfer money to another financial institution on our behalf.

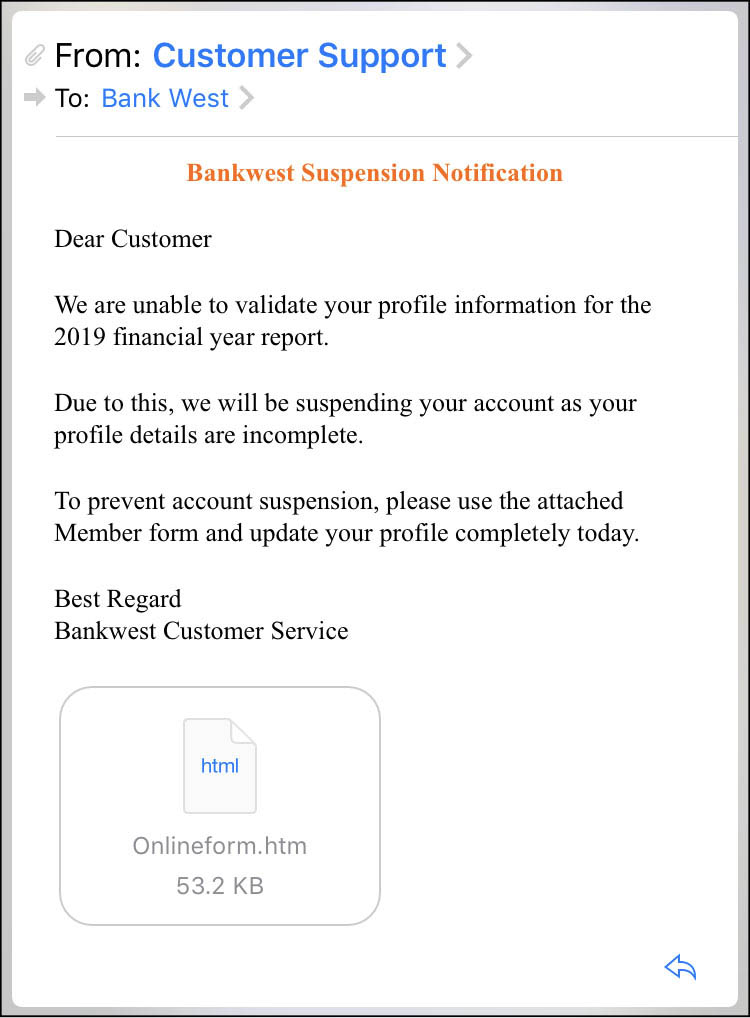

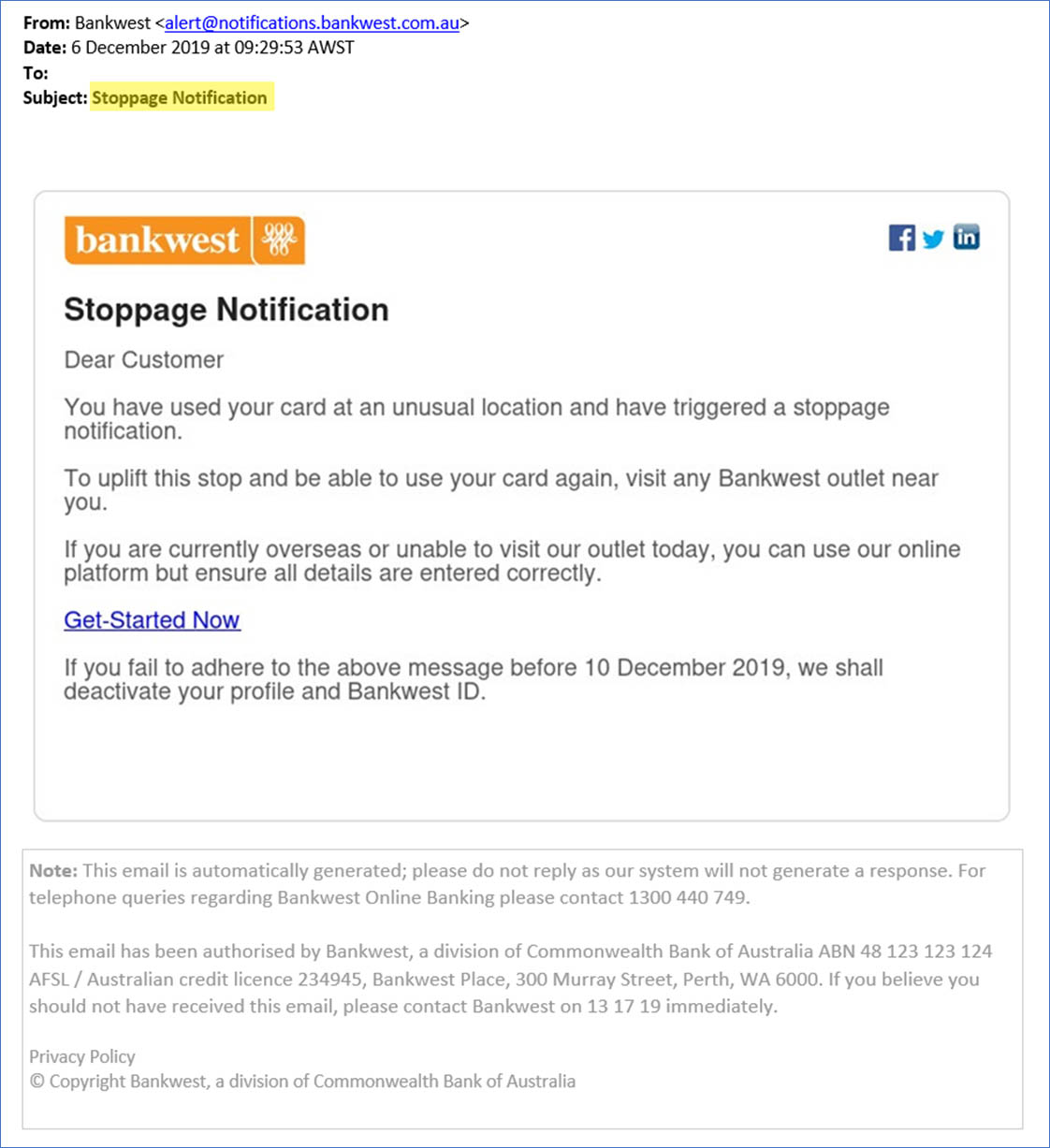

Fake Bankwest email and form

This email comes from an unauthorised part posing as us with the subject line ‘Bankwest Suspension Notification’ (we’ve included an example). Once opened, it asks you to fill out an attached form which provides the fraudster with your details.

If you’ve received an email like this, don’t open the attachment or provide any of your details. If you already have, call us on 13 17 19.

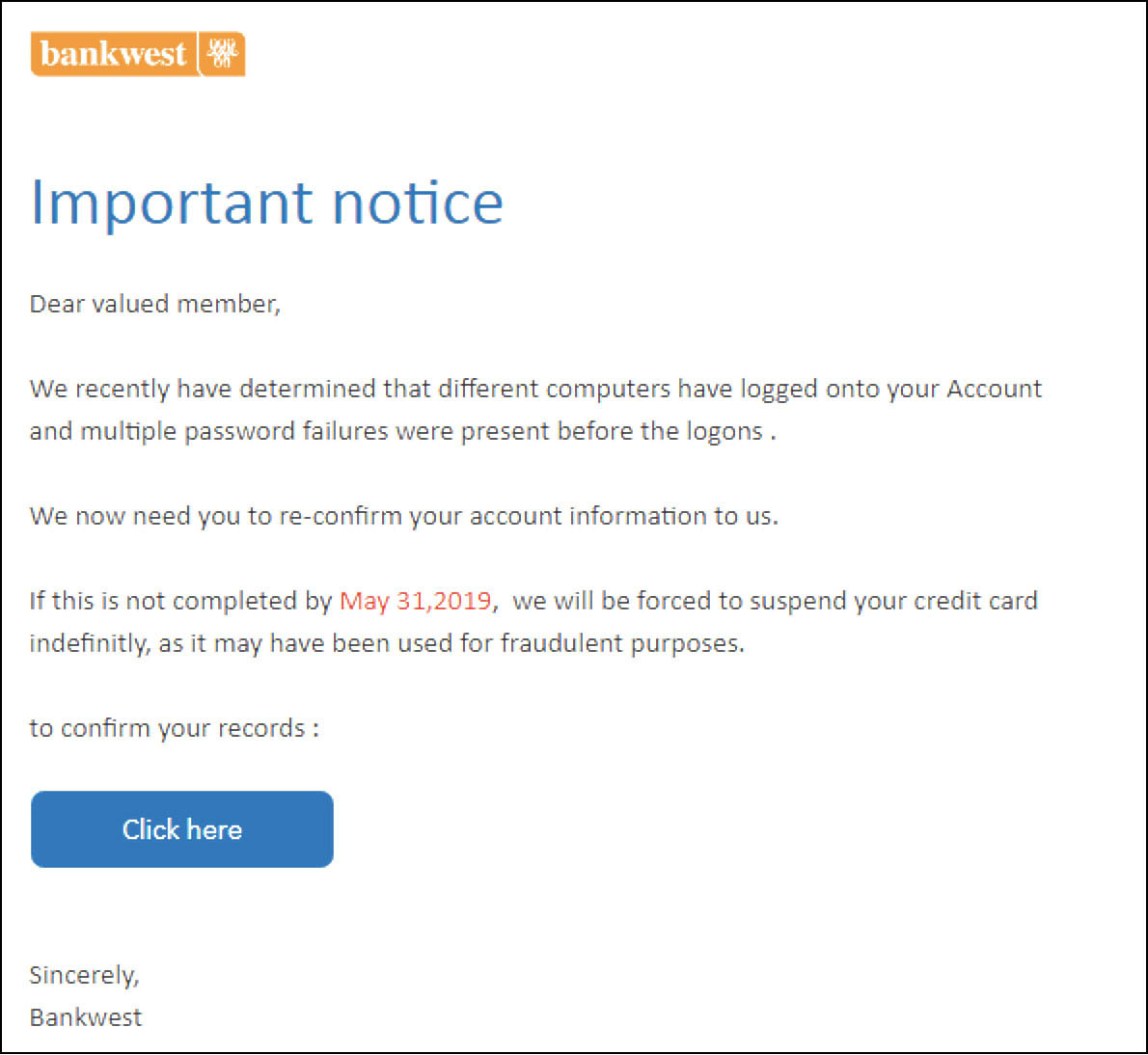

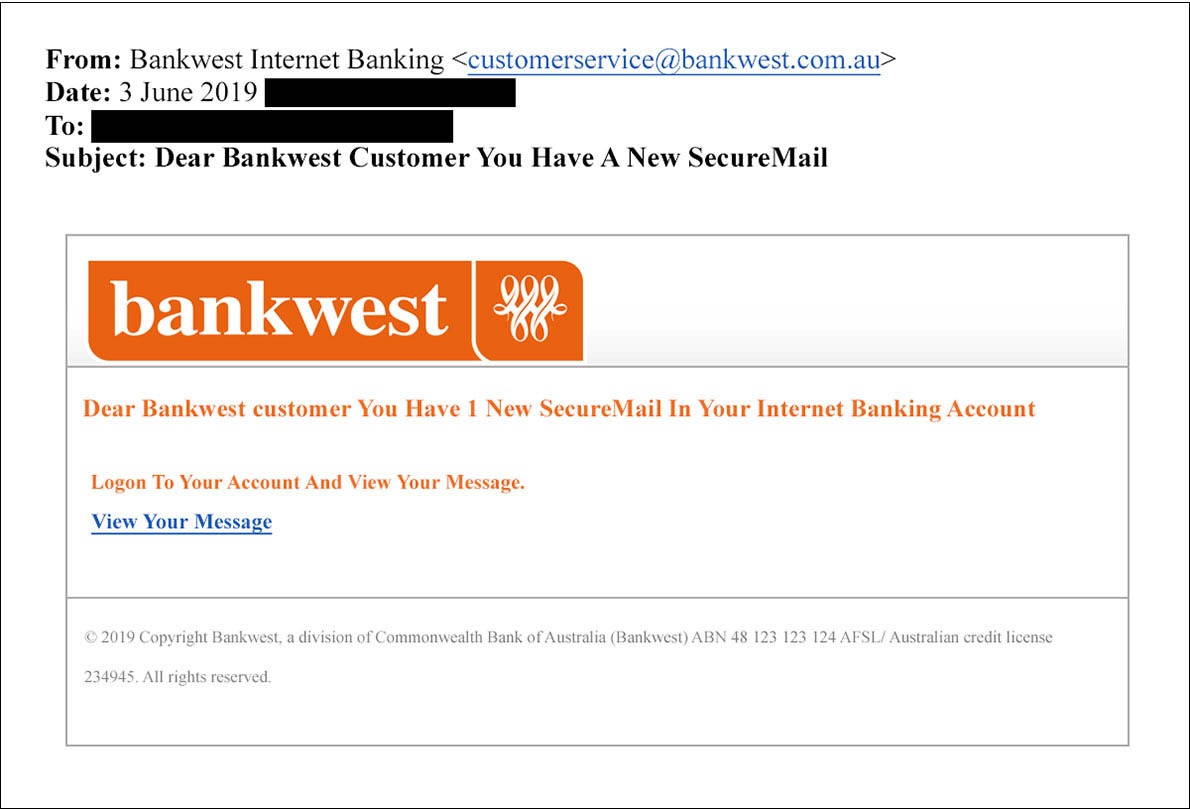

Fake Bankwest emails

These emails come from scammers posing as us, attempting to lure you into providing your bank details by clicking on specific links.

One email asks you to visit a link to avoid having your card suspended. The other asks you to log in to online banking to see a new ‘SecureMail’ message.

If you’ve received emails like these, don’t click the links or provide any of your details. If you already have, call us on 13 17 19.

Past threats

Free giveaway scams

This scam involves an iPhone giveaway across Facebook, Instagram, Google and YouTube. You’ll see a pop-up on your screen promising you a free iPhone for a small delivery fee, which then links to a fake website that prompts you to enter your card and personal details. Alternatively, you might be asked to complete a survey to receive the iPhone. Make sure you ignore these pop-ups.

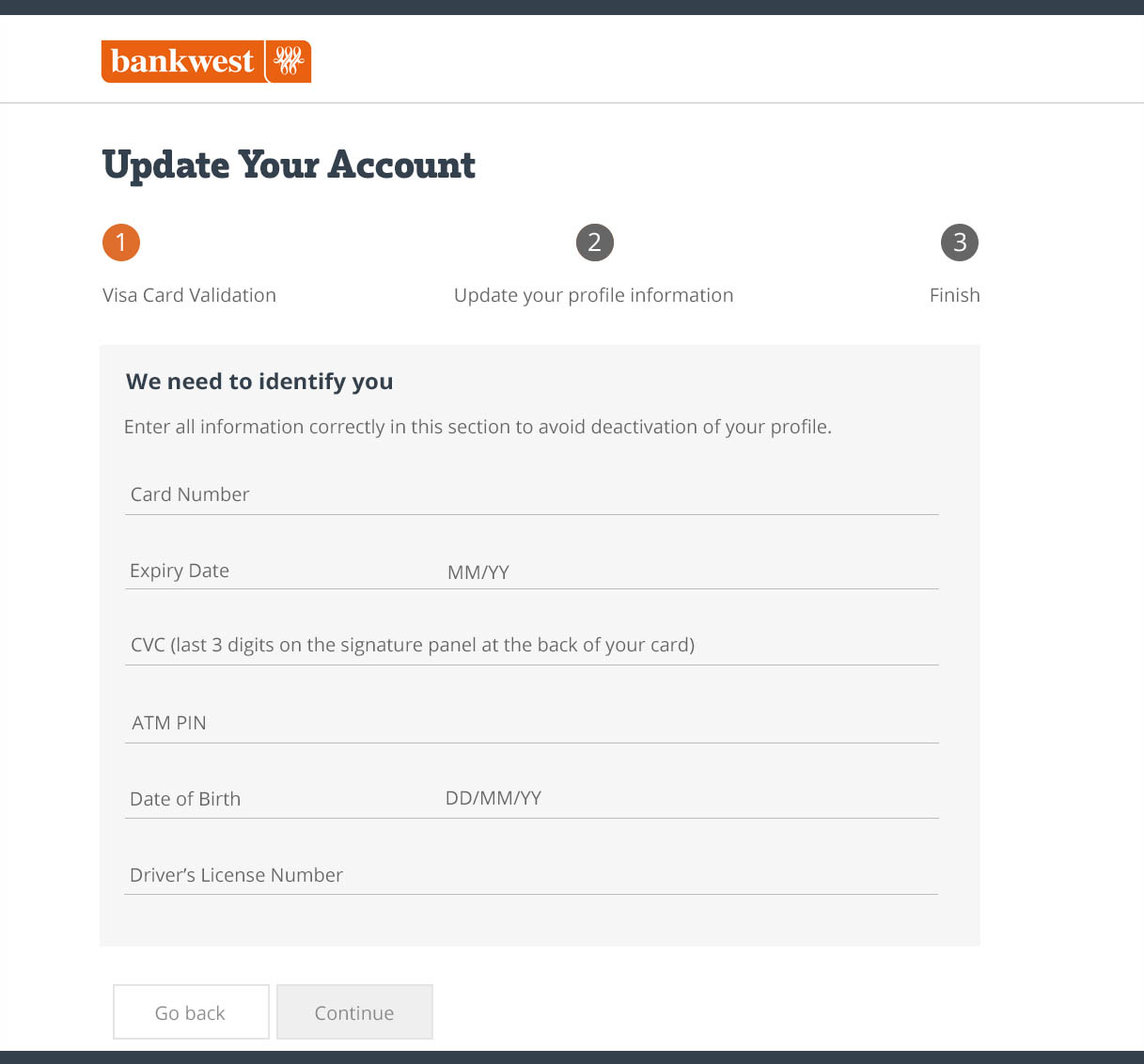

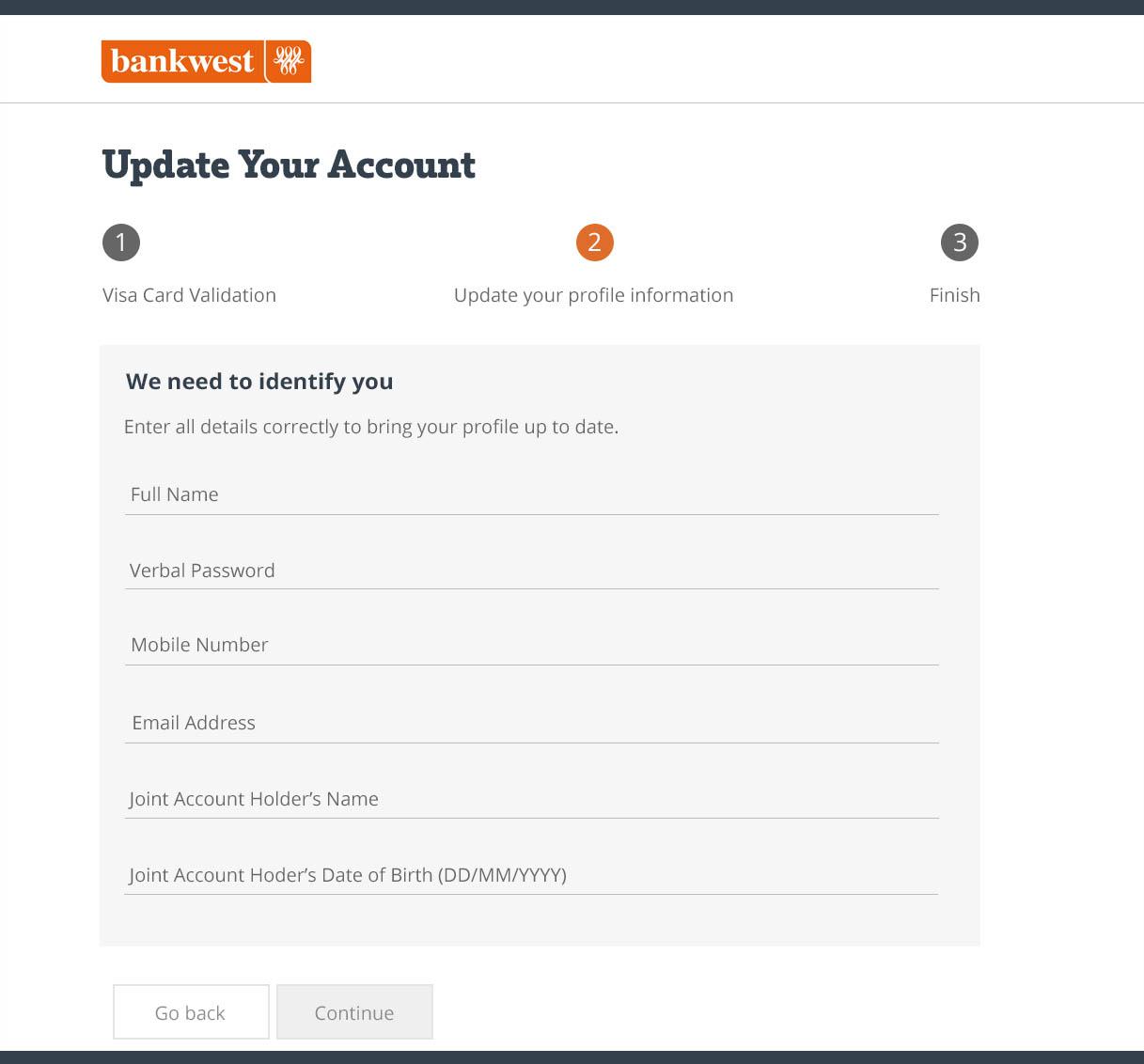

Blocked card phishing email

This email comes from scammers posing as us, attempting to get your personal details. They claim that your Bankwest card is blocked and ask you to click on a link to unblock it.

The link takes you a fake version of online banking, which takes your details after you log in. It then shows a form asking for some personal and account info. See examples of the initial email and fake form below.

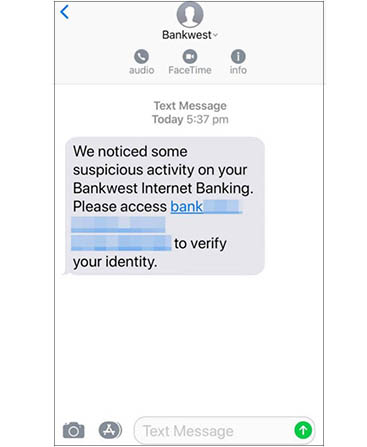

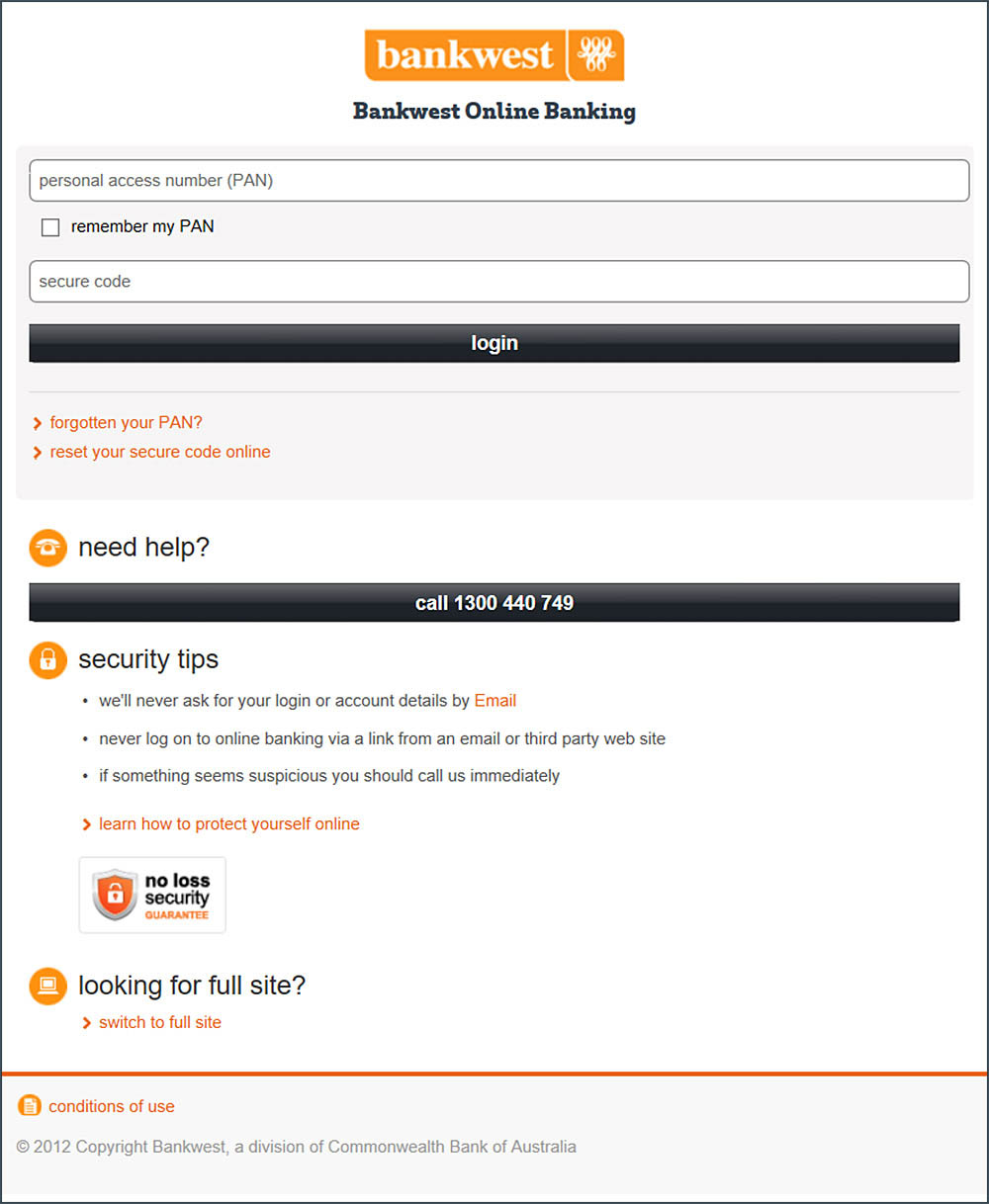

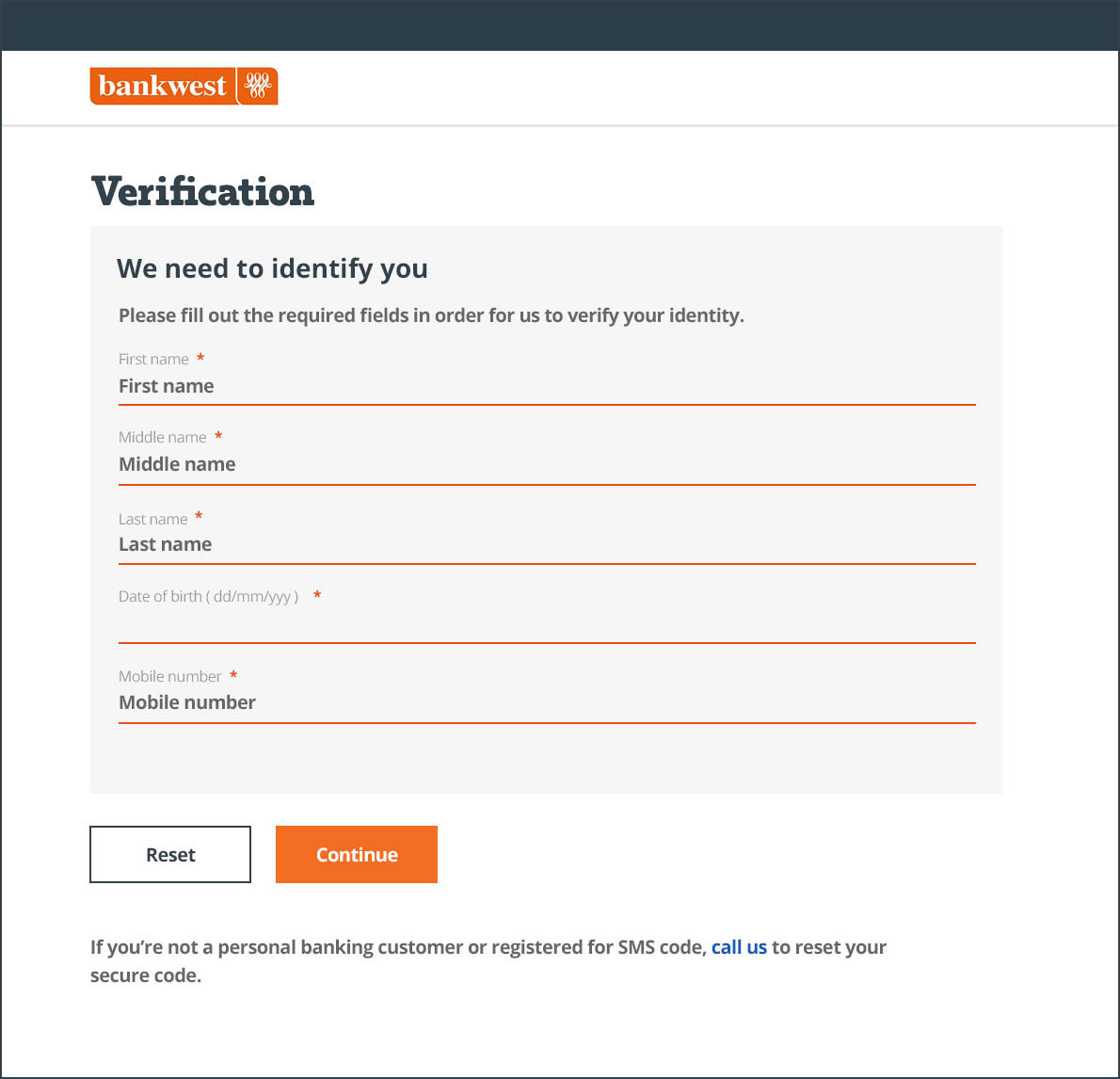

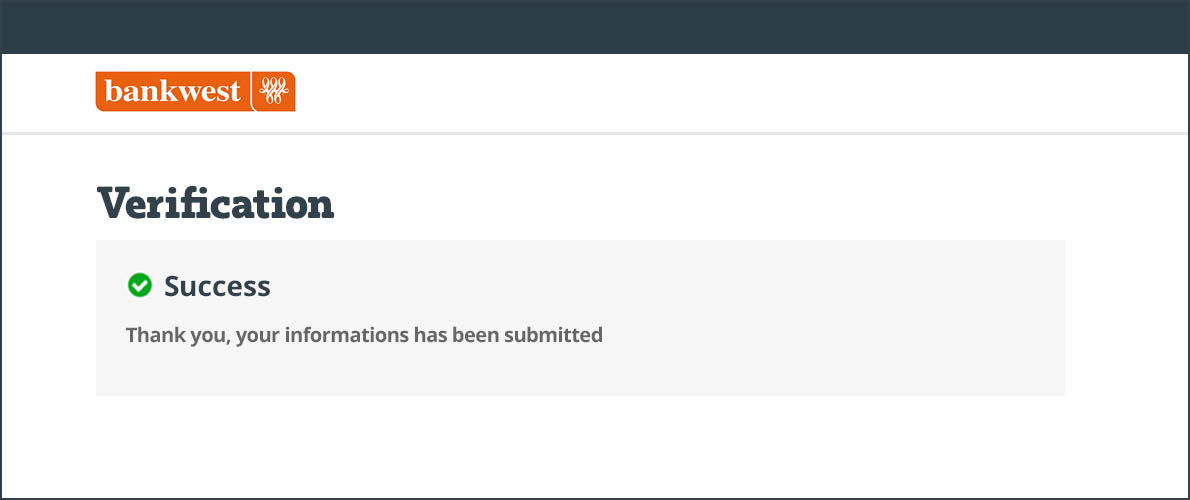

Fake SMS and Bankwest Online Banking login page

This SMS comes from scammers posing as us, trying to get you to click a link. This link sends you to a fake online banking login page which asks for your Personal Access Number (PAN) and secure code. You’re then directed to a fake ‘Verification’ page which asks for further details like your date of birth and mobile number. After these details are entered, the fake website redirects to our real website to try and make their request look legitimate. See an example below.

If you’ve received an SMS like this, don’t follow the link or try to respond. If you already have, call us on 13 17 19.

Fake Bankwest verification SMS

This involves scammers posing as us, trying to get you to click a link and provide your bank details. If you’ve received an SMS like this, don’t follow the link or try to respond. If you already have, call us on 13 17 19.

What to look out for

Scams often have common characteristics that will help you spot them.

Direct links to online banking

We won’t ever do this.

Unfamiliar screens

Especially if they ask for bank details and personal info.

Use of a generic greeting

We’ll always address you by name.

Anyone claiming to be us

If you’re unsure, you can call us back on 13 17 19.

Suspicious email addresses

Or a file attachment that doesn’t look right.

Email requests for more info

Like your name, date of birth or phone number.

Something not quite right?

Get in touch with us so we can look into it for you.

See something suspicious?

Call us immediately if you’re worried about possible fraud.

Is someone pretending to be us?

If you’re not sure about an email or SMS, don’t click any links or attachments.

Keep reading

Get expert tips on password setting, social media safety, device security and more.

Find out what to do if you see any suspicious account activity.

Keep an eye on your accounts with customised notifications.

There are things you should do before you leave and while you're away.

A guide to help older people avoid abuse, scams and fraud.